Chapter-wise Class 12 Accountancy Questions and Answers Free PDF Download

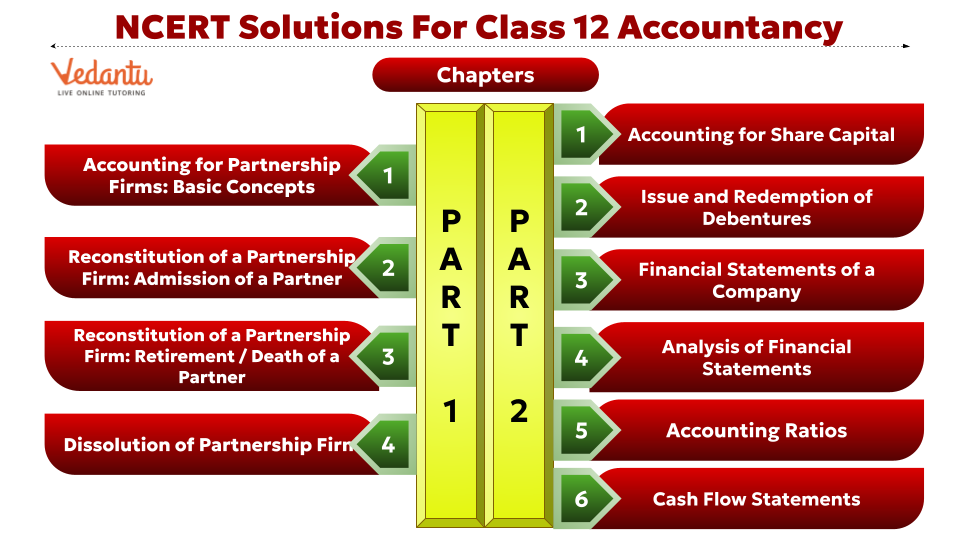

NCERT Solutions for Class 12 Accountancy Part 1 & 2

FAQs on NCERT Solutions For Class 12 Accountancy (2025-26)

1. Where can I find reliable, step-by-step NCERT Solutions for Class 12 Accountancy for the 2025-26 session?

Reliable and updated NCERT Solutions for Class 12 Accountancy, aligned with the 2025-26 CBSE syllabus, are available on major educational platforms like Vedantu. These solutions provide detailed, step-by-step answers for every question in the NCERT textbook, ensuring you learn the correct problem-solving methodology for the board exams.

2. How are the Class 12 Accountancy NCERT textbooks structured for the CBSE syllabus?

The Class 12 Accountancy syllabus is structured into two main parts, covered in two separate NCERT textbooks:

- Part A: Accounting for Partnership Firms and Companies - This part covers the foundational and advanced concepts of partnership accounts, including reconstitution and dissolution, as well as accounting for share capital and debentures.

- Part B: Financial Statement Analysis - This part focuses on analysing company financial statements, preparing accounting ratios, and creating cash flow statements.

3. Do the NCERT Solutions cover all chapters from both Part A and Part B of the Accountancy textbook?

Yes, comprehensive NCERT Solutions for Class 12 Accountancy cover all chapters from both textbooks as per the latest syllabus. This includes solutions for all exercises in chapters like Accounting for Partnership Firms: Fundamentals, Admission of a Partner, Accounting for Share Capital, Accounting Ratios, and Cash Flow Statements, ensuring complete preparation.

4. Are the NCERT Solutions for Class 12 Accountancy sufficient for scoring high marks in the board exams?

NCERT Solutions are the fundamental building block for board exam preparation as they are based on the prescribed textbook. To score high marks, you should use these solutions to master the correct formats and step-wise methods. For a top score, it is recommended to supplement this with practice from sample papers and previous years' question papers to understand the exam pattern and time management.

5. Which chapters in Class 12 Accountancy are often considered challenging, and how do NCERT Solutions help?

Students often find chapters like Cash Flow Statements, Redemption of Debentures, and Partnership Dissolution challenging due to their complex calculations and multiple scenarios. NCERT Solutions help by breaking down each problem into logical, easy-to-follow steps. They clarify the treatment of intricate adjustments, helping you understand the 'why' behind each accounting entry and calculation.

6. Why is it important to follow the exact step-by-step method provided in the NCERT Solutions when solving partnership or company accounts problems?

Following the exact method is crucial because the CBSE board awards marks for each logical step, not just the final answer. This includes marks for working notes, journal entries, ledger accounts, and the final balance sheet. The step-by-step approach in NCERT Solutions reflects the prescribed CBSE pattern, ensuring you don't lose marks for incorrect formatting or missing steps and demonstrating a clear conceptual understanding.

7. How do NCERT Solutions help in correctly applying the accounting treatment of Goodwill during the reconstitution of a partnership?

NCERT Solutions provide clear, worked-out examples for various scenarios involving Goodwill, such as a new partner's admission or a partner's retirement. They clearly show the calculation of the sacrificing ratio and gaining ratio, and the corresponding journal entries for adjusting Goodwill through the partners' capital accounts. This helps avoid common errors and builds a strong foundation on this critical topic.

8. What is the fundamental difference in the problem-solving approach for 'Accounting for Share Capital' versus 'Issue of Debentures' as explained in the NCERT solutions?

The key difference highlighted in the solutions lies in the nature of the funds. Share Capital represents ownership funds, so the solutions focus on complex entries for forfeiture, re-issue of shares, and maintaining the capital reserve. In contrast, Debentures are borrowed funds (a liability), so the solutions' approach emphasizes the conditions of issue (par, premium, discount) and the various methods and legal requirements for redemption.

9. Beyond providing correct final answers, what is the main purpose of using NCERT Solutions for preparing Cash Flow Statements?

The primary purpose is to develop analytical skills. The solutions teach the correct classification of cash flows into Operating, Investing, and Financing activities. More importantly, they explain the treatment of non-cash and non-operating items, such as depreciation or profit on sale of assets. This trains you to analyse a company's financial health by understanding its cash generation and usage patterns, which is a key objective of this chapter.

10. Why are the NCERT Solutions for Class 12 Accountancy divided into two parts: 'Accounting for Partnership Firms and Companies' and 'Financial Statement Analysis'?

This division reflects the logical flow of the accounting process. Part A, 'Accounting for Partnership Firms and Companies', focuses on the procedural aspect—recording and reporting transactions for different forms of business organisations. Part B, 'Financial Statement Analysis', focuses on the analytical aspect—using the financial data prepared in Part A to interpret a business's performance, profitability, and solvency through tools like ratios and cash flow statements.