An Introduction to IMF on Global Economic Issues

A widening range of global economic issues confronting today's economies offers both opportunities and risks to the success of their societies. Many industries have encountered problems and are still having trouble, and the nations that depend on those industries are now subtly attempting to recover.

While some difficulties are particular to a given area or nation, as economies become more interconnected, the health of one has more and more bearings on the health of others. At times like this, the IMF comes forward to give a helping hand in dealing with major global economic issues.

What is the IMF?

What is the IMF?

The International Monetary Fund (IMF) is an international organisation of 190 member countries to promote high employment and sustainable economic growth, secure financial stability, ease international trade, and lower poverty worldwide. It came into existence in 1945, and its headquarters are in Washington, DC.

The International Monetary Fund (IMF) has assisted nations in overcoming many global economic issues over the years. Additionally, the organisation is still developing and adapting to the dynamic global market.

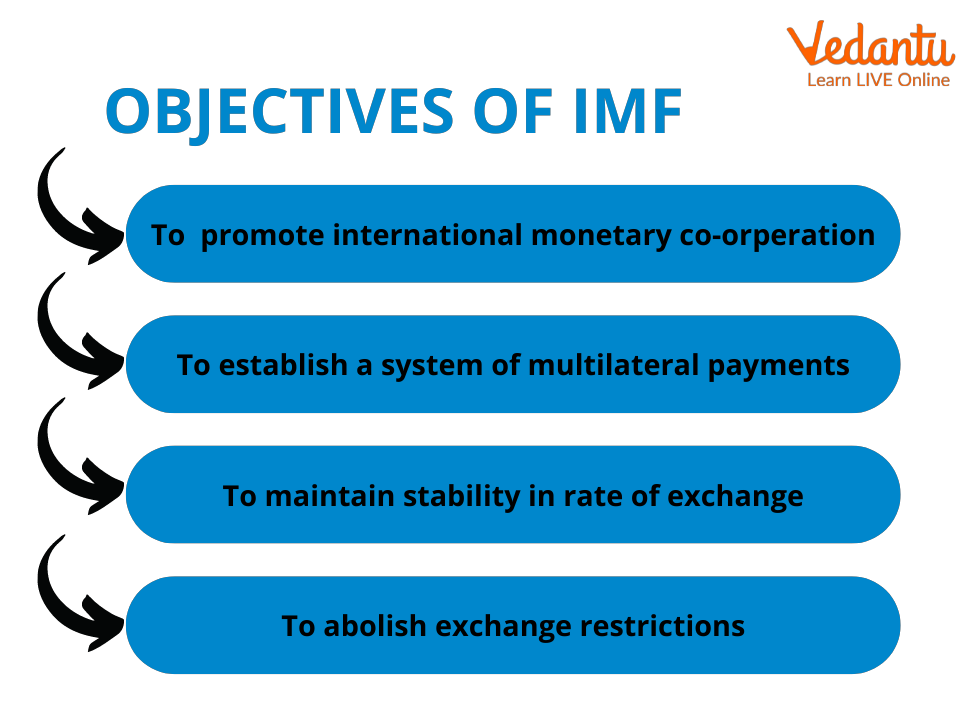

Objectives of IMF

Objectives of IMF

The major objectives of IMF include:

To encourage international monetary cooperation between the participating nations.

Promotion of exchange stability to maintain orderly exchange agreements between member nations.

Facilitating balanced expansion in the global economy to increase income and employment.

To develop a multilateral system of payments to facilitate international transactions among the member countries.

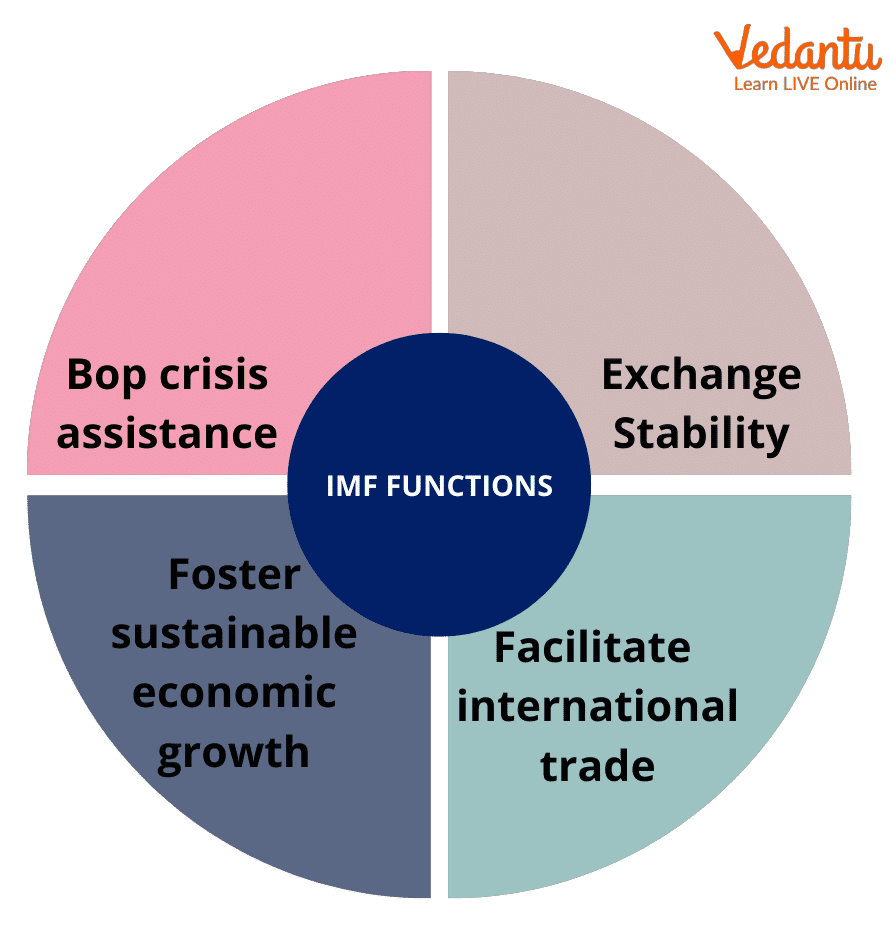

Functions of IMF

Functions of IMF

The major functions of IMF include:

Assisting member countries in getting short-term credits

Facilitating orderly currency exchange rate adjustments

To establish itself as a major foreign currency lending institution

Determining a country's currency value and making necessary changes to make an orderly adjustment of member countries' exchange rates

Ensuring stability in currency exchange rate mechanism to prevent competitive exchange depreciation

Role of IMF on Global Economic Issues

The IMF staff typically releases an IMF report twice a year. It presents the analyses of IMF staff economists on the short-term and long-term trajectories of global economic issues. Other ways in which IMF has played a major role in countering global economic issues are:

The IMF has historically been the body many nations have turned to during several global economic issues. Throughout the years, this organisation has played an essential role in giving economic aid to failing nations.

The IMF offers financial assistance to crisis-affected nations to have breathing room as they adopt adjustment measures to reestablish economic stability and prosperity.

Additionally, it offers preemptive funding to aid with crisis prevention and insurance. The IMF regularly improves its lending toolkit to accommodate nations' shifting needs.

The IMF maintains a continuous policy discussion with the governments of its member nations to maintain stability and prevent crises in the international monetary system.

It evaluates the state of the economy and makes policy suggestions that promote sustainable growth.

The IMF also keeps track of regional and international financial and economic developments.

However, these are just some of the IMF's many roles in global economic issues.

Case Study

Andorra joined the International Monetary Fund (IMF) in October 2020. A little nation called Andorra is situated between France and Spain. It is, nevertheless, Europe's biggest microstate. As the latest country to join the IMF, Andorra can now get annual reviews of its economy from the IMF, sometimes known as health checks, technical aid and, if necessary, IMF lending. This is especially helpful while the country deals with the COVID-19-related crisis.

1. Who is the latest member of the IMF?

Ans. Andorra, a little country between France and Spain, is the latest member to join the IMF.

2. IMF has how many members, including Andorra?

Ans. IMF has 190 members, including Andorra, who joined as the 190th member of the IMF.

Summary

The International Monetary Fund (IMF) is an organisation that supports world commerce, economic expansion, and financial stability. The IMF plays a huge role in dealing with global economic issues by providing loans, technical support, and oversight of economic policy. The IMF's major objectives are facilitating balanced expansion in the global economy and promoting international monetary cooperation.

Some major functions of the IMF include assisting and facilitating short-term credits and exchange rate mechanisms. The IMF's role in global economic issues includes providing financial and technical assistance to struggling nations.

FAQs on IMF on Global Economic Issues

1. What is the International Monetary Fund (IMF) and what are its primary objectives?

The International Monetary Fund (IMF) is a global organisation of 190 countries, established in 1944 at the Bretton Woods Conference. Its primary purpose is to ensure the stability of the international monetary system. Its key objectives are:

To promote international monetary cooperation and exchange rate stability.

To facilitate the expansion and balanced growth of international trade.

To provide financial assistance to member countries with balance of payments difficulties.

To offer technical assistance and surveillance to maintain global economic stability.

2. What are the main sources of funding for the IMF?

The IMF's financial resources primarily come from three main sources:

Member Quotas: This is the principal source of IMF funds. Each member country contributes a certain amount of money, called a quota subscription, based on its relative size and position in the world economy. Quotas determine a country's voting power and borrowing capacity.

New Arrangements to Borrow (NAB): A set of credit arrangements between the IMF and a group of member countries and institutions to provide supplementary resources to the IMF.

Bilateral Borrowing Agreements (BBAs): These are agreements with individual member countries to lend money to the IMF as a third line of defence if quota and NAB funds are insufficient.

3. How does the IMF differ from the World Bank?

While both the IMF and the World Bank are international financial institutions, their mandates and functions are different. The key difference lies in their core focus: the IMF concentrates on macroeconomic stability and the international monetary system, providing short-to-medium term loans to help countries with balance of payments problems. In contrast, the World Bank focuses on long-term economic development and poverty reduction, providing financing and technical assistance to developing countries for specific projects like building schools, hospitals, and infrastructure.

4. What are some examples of global economic issues the IMF addresses?

The IMF addresses a wide range of global economic issues that can destabilise the world economy. Some important examples include:

Managing high global inflation rates and their impact on economies.

Assisting countries facing sovereign debt crises to restructure their finances.

Analysing the economic impact of climate change and advising on policy.

Addressing economic disruptions caused by geopolitical conflicts and trade fragmentation.

Preventing financial contagion during a widespread financial crisis.

5. How does the IMF's surveillance function work to prevent global economic crises?

The IMF's surveillance function is a proactive measure to prevent economic crises. Through a process known as Article IV consultations, the IMF regularly monitors the economic and financial policies of its member countries. During these consultations, IMF economists analyse a country's economic health, identify potential risks to its domestic and global stability, and offer policy advice. This ongoing dialogue helps countries implement sound policies, correct imbalances before they become critical, and contribute to a more stable global economy.

6. What is the significance of the IMF's World Economic Outlook (WEO) report?

The IMF's World Economic Outlook (WEO) is a highly significant report published twice a year. It provides a comprehensive analysis of the state of the global economy and projects future trends for growth, inflation, trade, and other key indicators. Its importance stems from its role as a global benchmark for economic forecasting, influencing policy decisions by governments, investment strategies by financial markets, and business planning by corporations worldwide. The WEO highlights major risks and challenges, shaping the global discourse on economic policy.

7. What are the conditions attached to an IMF loan and why are they often criticised?

The conditions attached to an IMF loan, known as 'conditionality,' are a set of policies the borrowing country must agree to implement to receive financial assistance. These often include measures like reducing government spending, increasing taxes, privatising state-owned enterprises, and liberalising trade. The purpose is to ensure the country can repay the loan by resolving its balance of payments issues. However, they are often criticised because critics argue that these 'one-size-fits-all' policies can hurt the poorest citizens, increase unemployment in the short term, and undermine a country's ability to set its own economic policy.

8. How does the IMF's quota system reflect a country's power in the global economy?

The IMF's quota system is fundamental to its governance structure. A member's quota directly determines its financial contribution to the Fund, its access to IMF financing, and, most importantly, its voting power. Countries with larger economies, like the United States, have significantly larger quotas and therefore more votes. This means they have greater influence over the IMF's decisions, including the approval of loans and the setting of policies. This structure reflects the economic weight of member nations in the global system and is a frequent topic of debate regarding representation for emerging economies.