An Overview of Financial Economics

Financial economics study about the financial variables which concern the real economy. It is concerned with the allocating and deploying of economic resources while managing resources for uncertainty. It uses various economic theories to analyse risks and opportunity costs. Financial economics is based on macroeconomics and basic concepts of finance.

Understanding Financial Economics

How Does Financial Economics Work?

Financial economics considers the quantitative aspects of the financial market like inflation, deflation, boom, recession, prices, and many other financial variables. It works as:

It analyzes the actual valueof the asset and its cash flow generation. It also considers the activities that influence this cash flow generation.

It looks after any uncertainty or risk that may arise and tries to minimise these risks related to investments.

It considers the market regulations where financial instruments like bonds and securities are traded. It all comes under financial economics.

How Does Financial Economics work?

Why do We Study Financial Economics and Its Use?

Finance and Economics have an impact on everyone’s life. People are involved in production, consumption, use of goods and services, and also managing the issues of scarcity. Financial Economics gives a deep understanding of the fundamentals of economics, its impact, use in the decision-making process by linking it with quantitative aspects of finance. Studying financial economics helps in making rational decisions and working towards a bigger goal with proper forecasting and plans. Also, studying financial economics helps in career growth prospects which includes getting jobs in the field of economics, accounting, analysis, and consulting services. This domain has a huge score for individuals as well as society at large.

Methods of Financial Economics

In financial economics, there are many methods of getting to the concept, but the most prominent of them are the following:

Discounting

It is a process of converting a value which will be received in future to the same value which can be received immediately. The Rs 1 received today is not the same as received after 10 years. We need to take into consideration the time value of money.

Risk Management and Diversification

Risk can be managed by diversifying the portfolio. It is spreading your investments around to reduce its risk exposure. Through diversification, unsystematic risk can be mitigated.

Models of Financial Economics

There are two basic models/concepts of financial economics which are a) Capital Asset Pricing Model (CAPM) and b) Portfolio Theory.

Capital Asset Pricing Model (CAPM)

According to CAPM, investments are valued, and decisions are made on the basis of the time value of money, the risk involved, and the expected return. It is assumed that all the investors have similar expectations of both risk and return. Here, diversification is done to get more returns.

Portfolio Theory

It is a method where investments are selected for maximising the overall returns with the given level of risk. According to this theory, investors are risk-averse to a given level of return.

Finance v/s Economics

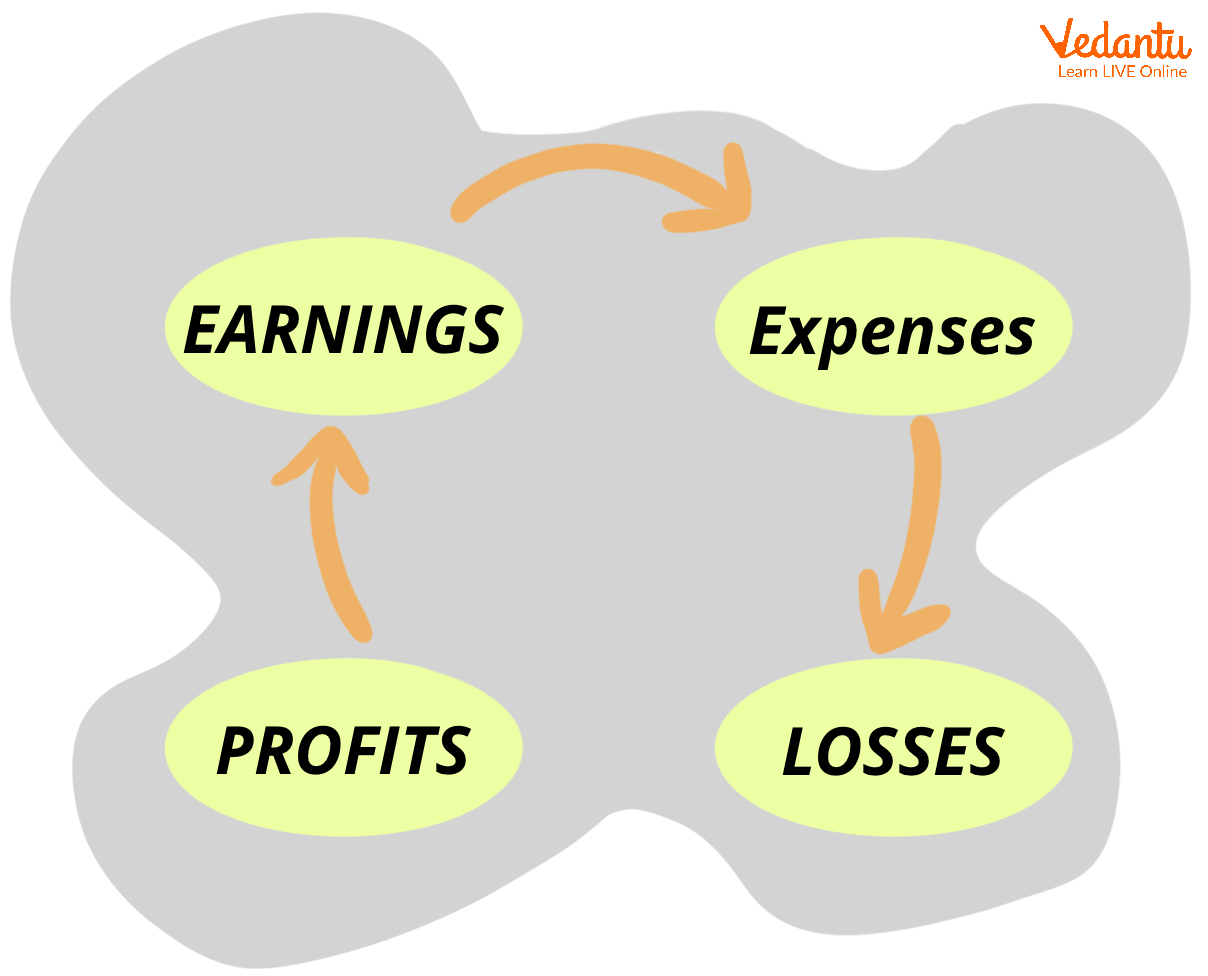

Finance and economics are separate disciplines, but they are interrelated to each other and also converge in some aspects. Finance is all about assessing the money and aspects of financial systems like banks, investments, credit etc. It is all about managing funds while keeping in mind the risk involved. Economics is the study of the scarcity of resources and how to fulfil unlimited wants with these scarce resources. It deals with what to produce, how to produce, and for whom to produce.

Case Study

The global financial crisis of 2008 affected the functioning of the financial system. It included a sharp decline in the prices of the asset, less volume of credit, and a balance sheet problem. This crisis affected the whole world and created a slowdown in the economies. This crisis was triggered by the collapse of subprime mortgage loans.

In this case, the use of financial economics is large as it helps in analysing the value of the asset and looks after the expected return and risk. It includes quantitative data, which helps to make the best investment decision and overcome any uncertainty. The business environment is quite uncertain, and in the growing globalised world, the use of financial economics is gaining importance.

Recession

Conclusion

Financial economics helps to understand the economy on a quantitative basis. It gives a wider perspective for decision-making by analysing the risk involved with an expected return. It talks about the economic condition in monetary terms and helps to value our investments and assets. This aspect of economics considers the financial variables and helps to take the best decision which has less risk and more return.

FAQs on Financial Markets: Overview and Types

1. What is a financial market and what are its primary functions?

A financial market is a marketplace where financial assets like shares, debentures, bonds, and currencies are created and exchanged. It acts as a crucial link between savers and investors, channelling funds from those who have a surplus to those who need them for productive use. Its primary functions include:

- Mobilisation of Savings: It provides a platform for savers to invest their money, directing it towards the most productive uses.

- Price Discovery: The interaction between demand and supply for a financial asset in the market helps in determining its price.

- Providing Liquidity: It allows investors to easily sell their financial assets and convert them into cash whenever required.

- Reducing the Cost of Transactions: By providing a common platform, it saves time, effort, and money for both buyers and sellers of financial assets.

2. What are the two main types of financial markets as per the CBSE syllabus?

As per the CBSE curriculum, the financial market is broadly classified into two main segments:

- Money Market: This is the market for short-term funds, dealing in monetary assets whose period of maturity is up to one year. It primarily caters to the temporary needs for cash for businesses and banks.

- Capital Market: This is the market for medium and long-term funds. It includes all the facilities and institutional arrangements for borrowing and lending of funds for periods of more than one year. It is further divided into the Primary Market and the Secondary Market.

3. How does the Capital Market differ from the Money Market?

The Capital Market and Money Market are two distinct components of the financial market, differing mainly in terms of maturity, instruments, and risk. The Capital Market deals with long-term securities (maturity > 1 year) like shares and debentures, involves higher risk, and aims to fulfil long-term credit needs for capital formation. In contrast, the Money Market deals with short-term securities (maturity < 1 year) like Treasury Bills and Commercial Papers, involves lower risk, and focuses on fulfilling short-term liquidity requirements.

4. What are the key instruments traded in the Money Market?

The Money Market deals with several instruments to meet short-term financial needs. The key instruments are:

- Treasury Bill (T-Bills): Short-term borrowing instruments issued by the Reserve Bank of India (RBI) on behalf of the Government of India.

- Commercial Paper (CP): An unsecured promissory note issued by large and creditworthy companies to raise short-term funds at lower rates of interest.

- Call Money: Short-term finance, repayable on demand, with a maturity period from one day to fifteen days, used for inter-bank transactions.

- Certificate of Deposit (CD): Unsecured, negotiable, short-term instruments in bearer form issued by commercial banks and development financial institutions.

- Commercial Bill: A bill of exchange used to finance the working capital requirements of business firms.

5. What is the fundamental difference between the Primary Market and the Secondary Market?

The fundamental difference lies in the type of securities traded. The Primary Market, also known as the new issues market, is where securities are sold for the first time. Companies issue new stocks and bonds to the public to raise capital. In contrast, the Secondary Market, commonly known as the stock market, is where existing, previously issued securities are bought and sold among investors. The company is not directly involved in transactions in the secondary market.

6. Why are financial markets essential for the economic growth of a country?

Financial markets are the backbone of an economy and are essential for its growth. They facilitate the transfer of funds from households (savers) to businesses (investors), a process known as capital formation. This allocation of capital to its most productive use leads to increased production, generation of employment, higher national income, and overall economic development. Without an efficient financial market, surplus funds would remain idle, and businesses would struggle to find resources for expansion and innovation.

7. What is a Stock Exchange and what is its role in the capital market?

A Stock Exchange is an organised and regulated market where securities like stocks, bonds, and other financial instruments are bought and sold. It is the most vital institution in the secondary market. Its key roles include providing liquidity and marketability to existing securities, ensuring fair price determination through demand and supply, promoting capital formation, and providing a safe and transparent environment for trading.

8. If the secondary market only deals with existing shares, how does it contribute to capital formation?

This is a common point of confusion. While it is true that the secondary market does not directly provide new capital to companies, it is indispensable for capital formation. It provides liquidity to securities. Investors are more willing to buy shares in the primary market because they know they can easily sell them in the secondary market (the stock exchange) if they need cash. This assurance of liquidity indirectly encourages investment in new issues, thereby facilitating the process of capital formation.

9. Who is the primary regulator of the capital markets in India, and what are its main objectives?

The primary regulator of the capital markets in India is the Securities and Exchange Board of India (SEBI). It was established to protect the interests of investors and to promote the development and regulation of the securities market. Its main objectives are:

- To protect investors: To safeguard the rights and interests of investors through adequate, accurate and authentic information.

- To prevent malpractices: To stop fraudulent activities like price rigging, insider trading, etc., in the capital market.

- To regulate and develop: To create a code of conduct for intermediaries such as brokers and underwriters and to develop a fair and efficient market.

10. For a student studying Commerce, what is the most practical importance of understanding financial markets?

Understanding financial markets is practically important for a Commerce student as it provides the foundational knowledge for future careers in finance, accounting, and business management. It helps in understanding how businesses raise money, how economies function, and the basics of personal investment and wealth creation. This knowledge is crucial for making informed financial decisions, whether as a business professional allocating company resources or as an individual managing personal savings and investments through instruments like SIPs (Systematic Investment Plans) or direct equity.