Introduction of Journal Entry

Journal entries are the initial stage in the accounting process. The procedure entails reviewing business transactions to see if they have an economic effect on the company's accounts. This process begins at the start of the accounting cycle and continues throughout the period.

After determining whether transactions impact the economy, the bookkeeper will record these transactions in the journal entry. A journal entry is a daybook or master diary that records all business transactions within an accounting cycle.

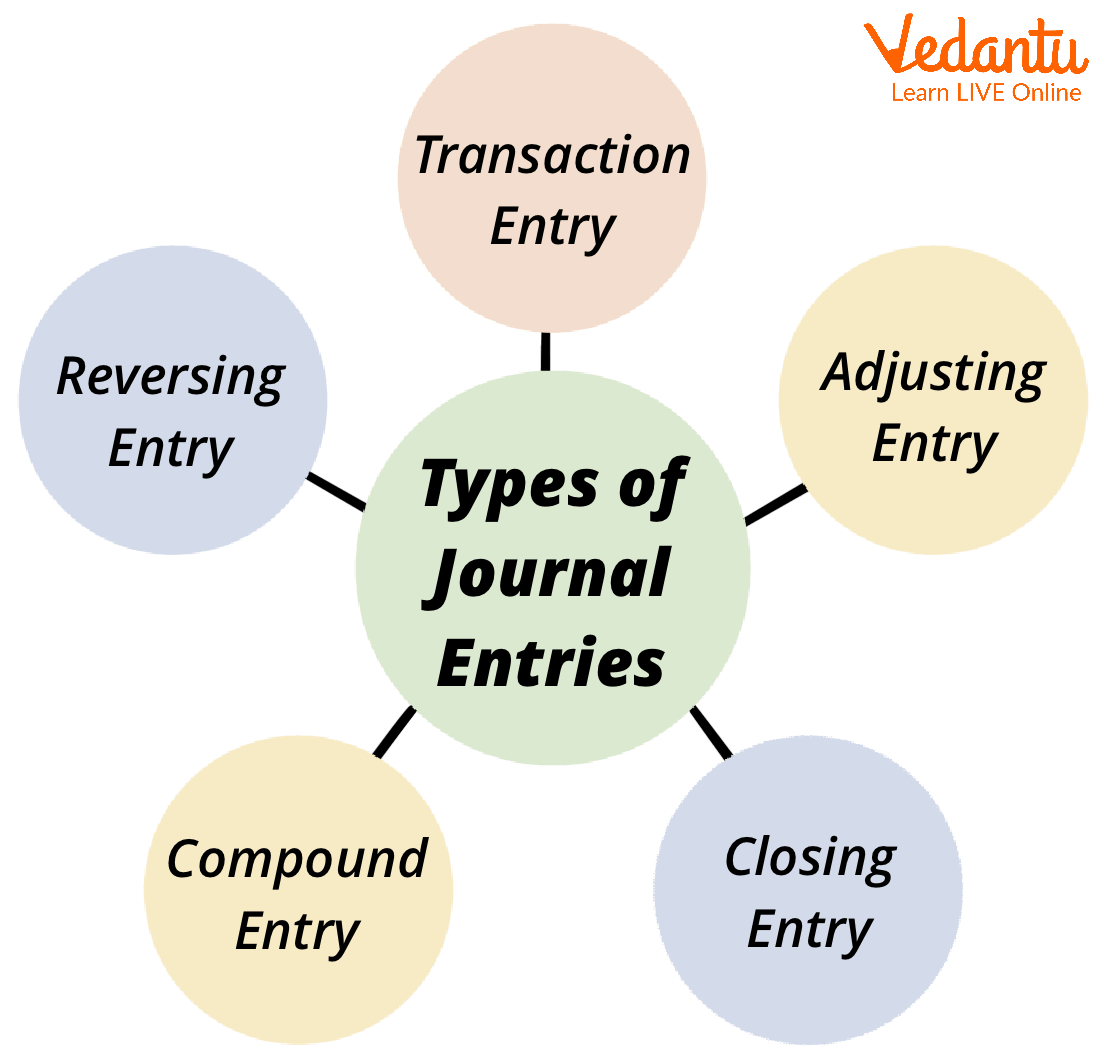

Types of Journal Entries

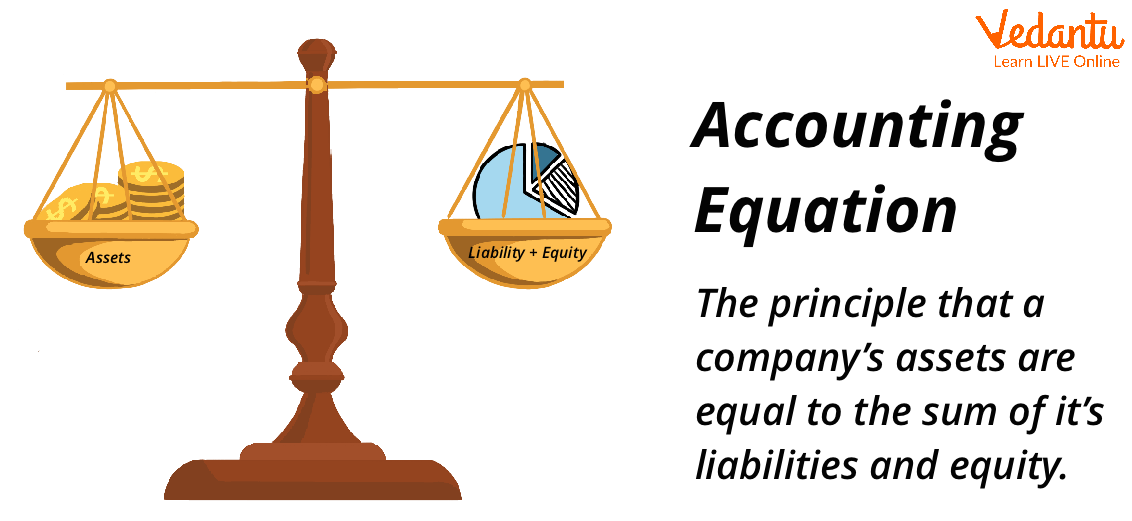

What is the Accounting Equation?

The accounting equation is a fundamental accounting principle and a key component of the balance sheet. The formula is as follows:

Assets = Liabilities + Shareholder’s Equity.

This equation establishes the cornerstone of double-entry accounting, often called double-entry accounting, and shows the balance sheet structure. Every transaction in double-entry accounting impacts at least one or two accounts.

An increase in an asset account, for example, can be matched by an equivalent rise in a corresponding liability or shareholder's equity account, ensuring that the accounting equation remains balanced. Alternatively, a rise in one asset account might be offset by a reduction in another. When conducting journal entries, it is critical to remember the accounting equation.

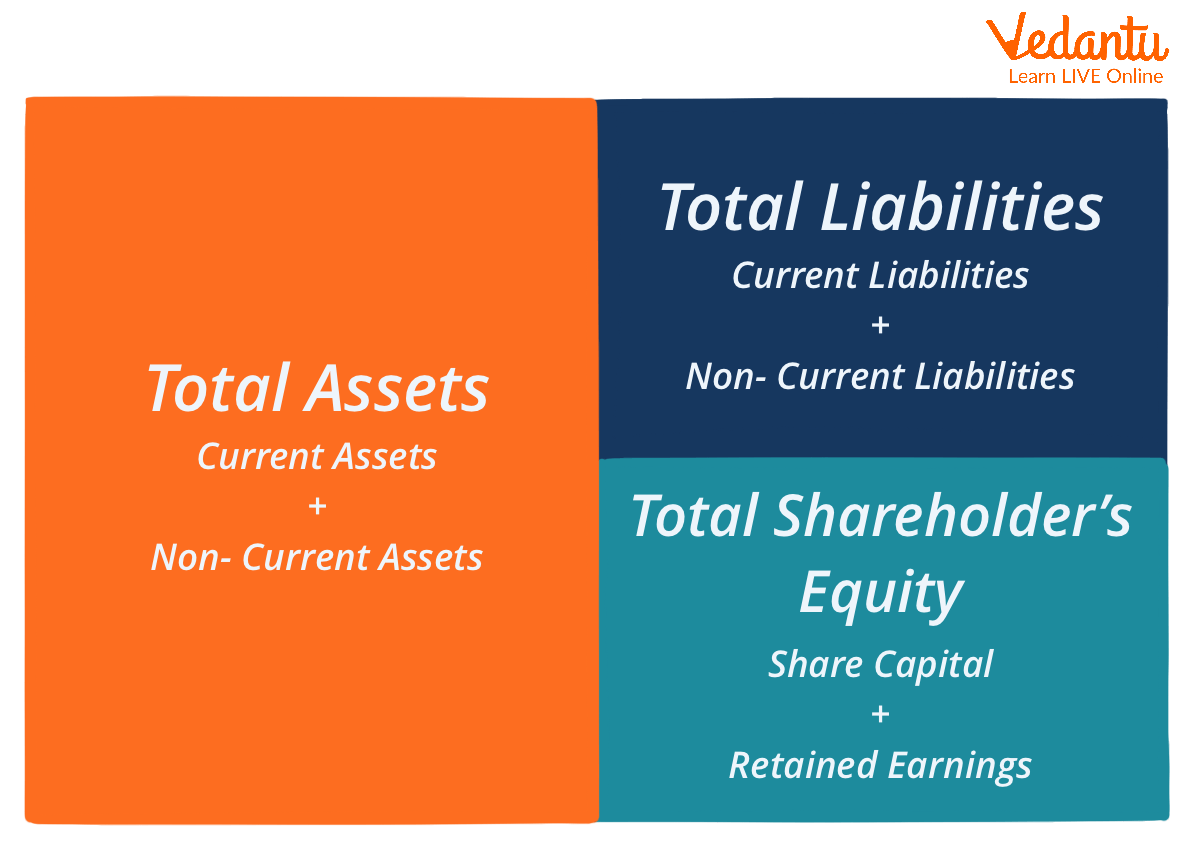

Accounting Equation Concept

How can this Equation Work?

The essential accounting system (Assets = Liability + Shareholders' Equity) is lengthened by the extended accounting system. The formula displays elements from the balance sheet's shareholders' Equity section.

The expanded accounting equation is:

Total Assets = Total Liabilities + CC +/- AOCIL + BRE + R – E – D – SR.

Where terms from the Shareholder’s Equity section of the balance sheet include:

CC is Contributed Capital

AOCIL is Accumulated Other Comprehensive Income (Loss)

BRE is Beginning Retained Earnings

R is Revenue

E is Expenses

D is Dividends (paid)

SR is Stock Repurchases

If the assets are not retired, they are referred to as treasury stock. Treasury stock purchases and sales are reported in retained profits and paid-in capital. The specifics of the transaction determine the journal entry.

Accounting Equation Formula

Accounting equation formula: Assets=(Liabilities + Owner’s Equity). As an illustration, suppose the prominent retail XYZ Corporation recorded the following on its income statement for its most recent full fiscal year:

Total assets: $170 billion

Total Liabilities: $120 billion

Total shareholders' equity: $50 billion

If we compute the right-hand side of the financial statement (equity + liabilities), we get ($ 50 billion + $120 billion) = $170 billion, which corresponds to the value of the company's assets.

Accounting Equation Formula

Accounting calculations

This equation is based upon the double-entry bookkeeping method, which implies that all assets in the book of accounts ought to equal all liabilities. A matching credit entry should accompany every item made to the balance sheet's debit side. As a result, it's also known as the balance sheet equation. A balance sheet equation can be represented as:

Total Assets = Total Liabilities + Total Shareholder’s Equity

Rules of Accounting Equation

Capital: Capital increases are recorded as credits, while capital withdrawals are recorded as debits.

Profit and, by extension, capital are increased by the interest paid on the former. Owner losses and expenses reduce available funds.

The interest earned on invested money and interest earned on withdrawal will not be shown in the balance sheet as either an asset or a liability.

Revenue: The revenue increases the owner’s equity/capital.

Expenses: The owner’s equity/capital is decreased by the number of expenses.

Owners’ Equity: Any rise in obligations results in a credit to the liability equity held by outsiders, whereas any reduction in liabilities results in a debit.

The asset account is credited if there is a rise in assets. The asset account is debited if there is a drop in assets.

Conclusion

The accounting equation displays the institution's valuable resources as obligations in the form of liabilities, assisting shareholders in determining the company's worth and establishing the link between them.

The accounting equation assures that the balance sheet is always balanced. For every debit entry, there is an equal credit entry (or coverage). Accounting equations are often known as fundamental accounting equations or balance sheet equations. Calculating the credits and debits of commercial transactions helps in preserving business efficiency.

FAQs on Journal Entries Using the Accounting Equation

1. What is the fundamental accounting equation and why is it important for a business?

The fundamental accounting equation is Assets = Liabilities + Owner's Equity (or Capital). It is important because it forms the foundation of the double-entry accounting system, ensuring that a company's books are always balanced. Every transaction a business undertakes must keep this equation in balance, reflecting that a company's assets are financed by either borrowing from others (liabilities) or through investments from its owners (equity).

2. How do you analyse a transaction's effect on the accounting equation before creating a journal entry?

To analyse a transaction, you must identify at least two accounts that are affected and determine how they impact the components of the accounting equation (Assets, Liabilities, Capital). For example, when a business purchases furniture for cash for ₹20,000, one asset (Furniture) increases by ₹20,000, while another asset (Cash) decreases by ₹20,000. The equation remains balanced as there is no change in the total value of assets, liabilities, or equity.

3. What are some examples of business transactions and their effect on the accounting equation?

Here are some common examples:

- Started business with cash: Increases Assets (Cash) and increases Owner's Equity (Capital).

- Purchased goods on credit: Increases Assets (Stock/Inventory) and increases Liabilities (Creditors).

- Paid salary to an employee: Decreases Assets (Cash/Bank) and decreases Owner's Equity (as it's an expense).

- Sold goods for cash: Increases Assets (Cash) and increases Owner's Equity (as it's revenue).

- Took a bank loan: Increases Assets (Bank) and increases Liabilities (Bank Loan).

4. How does the accounting equation serve as the basis for every journal entry?

The accounting equation is the core logic behind the rules of debit and credit used in journal entries. For every transaction, the total debits must equal the total credits. This duality directly reflects the accounting equation. For instance, an increase in an asset (a debit) must be balanced by a decrease in another asset, an increase in a liability, or an increase in equity (all credits). Therefore, a correctly passed journal entry will always keep the accounting equation in balance.

5. How do revenues and expenses affect the accounting equation?

Revenues and expenses directly impact the Owner's Equity component of the equation. Revenues (like sales or service fees) increase the owner's equity, as they represent earnings for the business. Conversely, expenses (like rent, salaries, or supplies consumed) decrease the owner's equity because they reduce the net assets of the business. This is why the expanded accounting equation is often shown as Assets = Liabilities + Capital + Revenues - Expenses.

6. Can a business transaction affect only one side of the accounting equation?

Yes, a transaction can affect only one side of the equation, as long as it maintains the balance. This typically happens on the Assets side. For example, if a company buys a machine for ₹50,000 in cash, one asset (Machinery) increases by ₹50,000, while another asset (Cash) decreases by the same amount. The total value of assets remains unchanged, and the 'Liabilities + Equity' side is not affected at all.

7. What is the main difference between the accounting equation and a Balance Sheet?

The accounting equation (Assets = Liabilities + Equity) is the underlying principle or formula that governs all accounting. The Balance Sheet, on the other hand, is the formal financial statement that presents this equation in a structured format for a specific point in time. Essentially, a Balance Sheet is the practical application and detailed report of the accounting equation, listing all specific assets, liabilities, and equity accounts of a company.

8. Is the concept of the accounting equation relevant for CBSE Class 12 studies?

While the accounting equation is introduced and taught as a foundational concept in CBSE Class 11, its principles are fundamental to all accounting topics in Class 12 and beyond. In Class 12, concepts like Partnership Accounts, Company Accounts (Shares and Debentures), and preparation of financial statements all implicitly rely on the accounting equation remaining in balance. It is not re-taught but is continuously applied.