Behavioural Economics: An Introduction

Behavioural Economics is a field which involves the study of Psychology and deals with the economic decision-making processes of an entity, an individual or an institution.

Introduction to Behavioural Economics

What is Behavioural Economics?

Behavioural Economics explains the irrational economic decisions taken by individuals sometimes. It helps understand why a person chooses Choice A instead of Choice B. In the present era, when there is a variety of choices available for people, the Rational Choice theory of economics comes into play. This theory states that when humans have various options under conditions of scarcity, they choose the option which gives them maximum satisfaction. According to the theory, after rationally doing a cost and benefit analysis of every option available to them under the circumstances, choose the best option.

Behavioural Economics

Behavioural Economics also seeks to explain how irrational economic decisions tend to affect an individual. Behavioural Economics explains the reasons behind irrational decisions made by an individual. As humans have emotions, distractions and varying self-control, they sometimes choose an option which is not rational and thus gets affected afterwards.

Six essential Behavioural Economics principles are:

The Overconfidence Effect

Temporal Discounting

Loss Aversion

Anchoring and Framing

Social Norms

The Peak-End Rule

Behavioural Approach

Behavioural Approach is concerned with the behaviour of human beings rather than the mind. It involves a behavioural decision making process. This approach advocates that human behaviour is a learned aspect; therefore, all behaviours can be unlearned, and new behaviour learned in their place. The Behavioral approach is the most effective way of treating Behavioural Disorders and other Impulse Control disorders. This can also be used to treat anxiety and other mental disorders. BF Skinner is the founder of the Behavioural Approach.

The behavioural approach takes into consideration that human beings are not incapable of making errors and that through rational decision-making and proper behaviour control, errors can be amended.

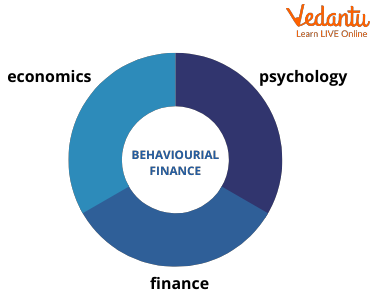

Behavioural Finance

Behavioural Finance deals with studying the psychology of investors and financial markets. Behavioural Finance explains why investors make decisions that are not in their best interest. It focuses on rational decision-making.

Behavioural Finance

Summary

Behaviour Economics has its foundation in the Behavioural Approach, which believes that the behaviour of human beings is dynamic and thus can be learned and unlearned. It requires efforts to change behavioural patterns. This behavioural approach is utilised in almost every discipline since it provides a sense of positive affirmation. Some of the behavioural economics examples are very common. In Healthcare, patients tend to believe that they will be cured after treatment. In education, students tend to perform better when provided a small treat. Behavioural Economics, in the same way, focuses on making the best choices and keeping the situations in mind.

FAQs on Behavioral Economics: The Psychology of Decisions

1. What is Behavioral Economics and how does it relate to the psychology of decisions?

Behavioral Economics is a field of study that combines insights from psychology and economics to understand how people make economic decisions. It challenges the traditional economic assumption that humans are always rational. Instead, it explores how psychological factors like cognitive biases, emotions, and social influences cause individuals to make choices that may not seem perfectly logical but are predictably human.

2. How does Behavioral Economics differ from traditional Classical Economics?

The primary difference lies in their assumptions about human behavior. Classical Economics assumes people are fully rational, possess complete information, and always act in their self-interest (a concept known as 'homo economicus'). In contrast, Behavioral Economics acknowledges that human decision-making is often influenced by mental shortcuts, emotional responses, and social pressures, leading to decisions that are 'predictably irrational'.

3. What are some core principles or concepts in Behavioral Economics?

Behavioral Economics is built on several key principles that describe common human behaviors. Some of the most important ones include:

Anchoring: The tendency to rely heavily on the first piece of information offered (the 'anchor') when making decisions.

Loss Aversion: The principle that the pain of losing something is psychologically twice as powerful as the pleasure of gaining something of equal value.

Framing: How the presentation or 'framing' of a choice can influence the decision made, even if the underlying options are identical.

Nudge Theory: The idea of subtly guiding people toward better decisions without restricting their freedom of choice.

4. Can you provide a real-world example of Behavioral Economics in action?

A classic example is the use of default options. For instance, when companies automatically enrol employees in a retirement savings plan but give them the option to opt-out, participation rates are significantly higher than when employees must actively choose to opt-in. This leverages the human tendency to stick with the default choice (status quo bias) to 'nudge' them towards saving for their future.

5. Why is studying Behavioral Economics important for a commerce student?

For a commerce student, understanding Behavioral Economics is crucial for several reasons. It provides deeper insights into consumer behavior, which is essential for marketing and sales strategies. It also helps in understanding investor psychology for finance, designing better employee incentives in human resources, and creating more effective public policies. It equips students with a more realistic model of how economies actually function.

6. How is Behavioral Economics applied in business and government policy?

Businesses use it to design pricing strategies (e.g., decoy pricing), improve product placement, and frame marketing messages. Governments apply its principles to encourage positive behaviors like paying taxes on time, increasing organ donation rates, and promoting healthier lifestyles by making healthy food choices more visible and accessible in cafeterias. This is often done through dedicated 'Nudge Units'.

7. Who are the founding fathers of Behavioral Economics?

While many have contributed, psychologists Daniel Kahneman and Amos Tversky are widely considered the pioneers of the field. Their work on prospect theory and cognitive biases laid the groundwork for modern behavioral economics. Economist Richard Thaler, who coined the term 'nudge', is also a central figure and won the Nobel Prize in Economic Sciences for his contributions.

8. Is 'nudge theory' a form of manipulation?

This is a common ethical debate. A 'nudge' is defined as an intervention that guides choice without forbidding any options or significantly changing economic incentives. Proponents argue that it's a form of 'libertarian paternalism'—steering people towards beneficial outcomes while preserving their freedom to choose otherwise. However, critics raise concerns about transparency and the potential for it to be used for manipulative purposes if not applied ethically.